Recent research shows a “high percentage of people . . . find personal financing incredibly intimidating,” says Frank Chisholm, director of brand and marketing for Kindred Credit Union. Some people feel guilty for starting financial planning too late in life. Others experience barriers when it comes to accessing financial products and services. Throw in a pandemic causing people to re-evaluate their priorities, and there is an appetite for help to manage one’s finances.

Ben Janzen, director of values integration at Kindred, points to what he calls the “beautiful purpose statement” of Kindred as a starting point; it provides “cooperative banking that connects values and faith with finances inspiring peaceful, just and prosperous communities.”

Offering workshops in financial literacy is one way Kindred lives out that vision.

Staff volunteer their time to offer Each One Teach One (EOTO), a program of the Canadian Credit Union Association. “Delivered in plain language in schools, church basements . . . and community centres,” the approach of EOTO is “meeting people where they are at with the literacy that they need at the time.”

The program is open to members and non-members of Kindred. During the pandemic, it moved online, and already this year more than 20 of the interactive workshops have been offered to a few hundred people.

Designed for adults, they last between 60 and 90 minutes and cover 17 topics, including: basic banking, budgeting, credit cards, loans, home ownership and retirement savings. They can be tailored for a variety of community groups.

Janzen says the “financial system is not built for marginalized groups,” but they need this information. Barriers might include language, systemic racism or lack of access to technology. Janzen wants to modify or translate content in order to address and try to overcome some of the barriers.

For Kindred staff, financial literacy is part of a larger context. In consultation with their community and staff, they have developed a Community Inspiration Framework, made up of 10 themes, to guide how they make their purpose statement tangible.

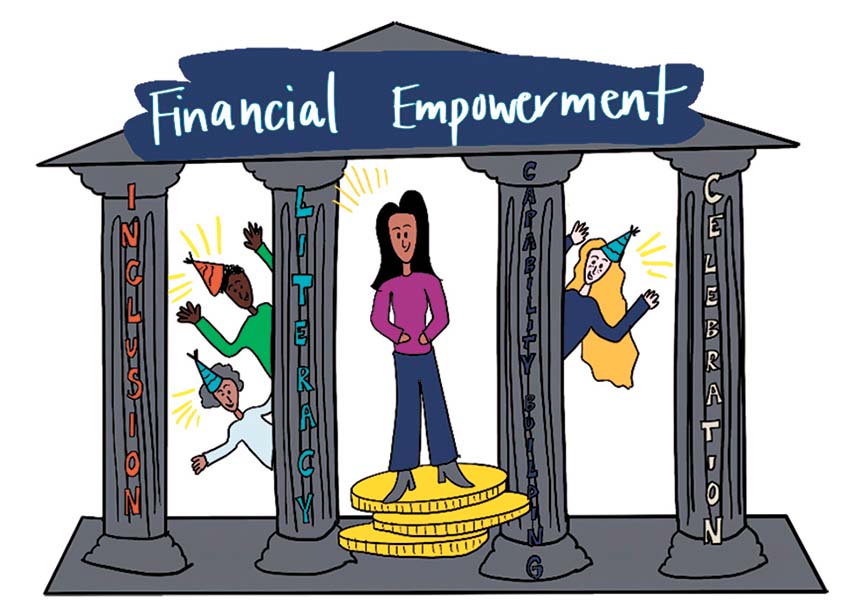

Amy Zavitz, community engagement specialist at Kindred, describes “financial empowerment” as one relevant theme with four pillars:

- Inclusion: Who can access products and services? What are the barriers, and why?

- Financial literacy: Building skills and knowledge.

- Capability building: Feeling empowered to take control of your finances and make a plan.

- Celebration: Marking goals and milestones, like graduation, vacation and home ownership.

Janzen says that being literate is not enough in order to fully participate. In addition, people “need to feel included, see themselves in what is happening, and have access to products and services” that can “meet unique population needs.”

They also need what he calls “values literacy” in order to choose financial products and services. Branch staff educate members, ask about their values, and try to meet them where they are.

“We would never sell a product to a member who didn’t know what it was and how it works,” Janzen says. “Our value system is not about accumulation of wealth.” One unique thing Kindred members want is education on socially responsible investing.

Max Bentz, vice-president of member relations, says mutual aid is a founding value of Kindred, and topics such as tithing and charitable giving are part of the conversation.

Chisolm says that being a good steward of what God has provided is a “core value” that is “part of our DNA.” He adds that, when members are in financial difficulty, there are some crisis-care services Kindred can offer because other members have put money on deposit at low interest.

Kindred is also a “living wage champion,” affirming that “paying a living wage aligns with our values and it’s a critical investment in our collective prosperity.”

Chisholm sees financial literacy as something that has happened naturally, in the day-to-day conversations staff have with members since Kindred began in 1964.

Bentz says, “It’s all about relationships . . . being able to walk with the members no matter if they’ve got a million dollars to invest or a hundred dollars to invest.”

Beyond EOTO, there are more advanced workshops on topics like how to start a registered education savings plan or get an appraiser.

Janzen says financial literacy can be important at any stage of life, and it can benefit individuals, businesses and non-profit organizations.

Chisholm says Kindred offers a free resource that helps churches do a “spring cleaning” of their finances, as they try to maintain viability through the pandemic.

Janzen sees financial literacy as part of a commitment to walk with people through all the stages of their lives. We are “in it for the long haul—the long-term health of our members.”

This article appears in the Sept. 13, 2021 print issue, with the headline “Making a ‘beautiful purpose statement’ tangible.” Do you have a story idea about Mennonites in Eastern Canada? Send it to Janet Bauman at ec@canadianmennonite.org.

LnRiLWdhbGxlcnkgdWx7bGlzdC1zdHlsZTpub25lO21hcmdpbjowIDAgMS41ZW0gMDtwYWRkaW5nOjB9LnRiLWdhbGxlcnlfX2NlbGx7bWFyZ2luOjAgIWltcG9ydGFudDtwb3NpdGlvbjpyZWxhdGl2ZX0udGItZ2FsbGVyeS0tZ3JpZHtkaXNwbGF5OmdyaWQ7Z3JpZC1hdXRvLXJvd3M6YXV0byAhaW1wb3J0YW50fS50Yi1nYWxsZXJ5LS1ncmlkOm5vdCgudGItZ2FsbGVyeS0tZ3JpZC0tbm9jcm9wKSAudGItYnJpY2tfX2NvbnRlbnR7aGVpZ2h0OjEwMCU7cG9zaXRpb246YWJzb2x1dGU7dG9wOjB9LnRiLWdhbGxlcnktLWdyaWQ6bm90KC50Yi1nYWxsZXJ5LS1ncmlkLS1ub2Nyb3ApIC50Yi1nYWxsZXJ5X19jZWxse2dyaWQtcm93LWVuZDp1bnNldCAhaW1wb3J0YW50O3Bvc2l0aW9uOnJlbGF0aXZlfS50Yi1nYWxsZXJ5LS1ncmlkOm5vdCgudGItZ2FsbGVyeS0tZ3JpZC0tbm9jcm9wKSAudGItZ2FsbGVyeV9fY2VsbDo6YmVmb3Jle2NvbnRlbnQ6IiI7ZGlzcGxheTppbmxpbmUtYmxvY2s7cGFkZGluZy1ib3R0b206MTAwJX0udGItZ2FsbGVyeS0tZ3JpZDpub3QoLnRiLWdhbGxlcnktLWdyaWQtLW5vY3JvcCkgLnRiLWdhbGxlcnlfX2NlbGw6Om1hcmtlcntjb250ZW50OiIifS50Yi1nYWxsZXJ5LS1ncmlkOm5vdCgudGItZ2FsbGVyeS0tZ3JpZC0tbm9jcm9wKSBpbWd7d2lkdGg6MTAwJTtoZWlnaHQ6MTAwJTstby1vYmplY3QtZml0OmNvdmVyO29iamVjdC1maXQ6Y292ZXJ9LnRiLWdhbGxlcnktLWdyaWQtLW5vY3JvcCBpbWd7aGVpZ2h0OmF1dG8gIWltcG9ydGFudDt3aWR0aDphdXRvICFpbXBvcnRhbnR9LnRiLWdhbGxlcnktLWdyaWQtLW5vY3JvcCAudGItZ2FsbGVyeV9fY2VsbHthbGlnbi1zZWxmOmVuZH0udGItZ2FsbGVyeS0tZ3JpZC0tbm9jcm9wIC50Yi1icmlja19fY29udGVudHtoZWlnaHQ6MTAwJX0udGItZ2FsbGVyeS0tY29sbGFnZXtkaXNwbGF5OmdyaWQ7Z3JpZC10ZW1wbGF0ZS1jb2x1bW5zOnJlcGVhdCgxMiwgMWZyKX0udGItZ2FsbGVyeS0tY29sbGFnZSAudGItYnJpY2tfX2NvbnRlbnR7aGVpZ2h0OjEwMCV9LnRiLWdhbGxlcnktLWNvbGxhZ2UgaW1ne2hlaWdodDoxMDAlICFpbXBvcnRhbnR9LnRiLWdhbGxlcnktLW1hc29ucnl7ZGlzcGxheTpncmlkO2dyaWQtcm93LWdhcDowO2dyaWQtYXV0by1yb3dzOjFweDtvcGFjaXR5OjB9LnRiLWdhbGxlcnktLW1hc29ucnkgLnRiLWJyaWNrX19jb250ZW50e3Bvc2l0aW9uOnJlbGF0aXZlfS50Yi1nYWxsZXJ5LS1tYXNvbnJ5IC50Yi1icmlja19fY29udGVudCBpbWcsLnRiLWdhbGxlcnktLW1hc29ucnkgLnRiLWJyaWNrX19jb250ZW50IGlmcmFtZSwudGItZ2FsbGVyeS0tbWFzb25yeSAudGItYnJpY2tfX2NvbnRlbnQgdmlkZW97LW8tb2JqZWN0LWZpdDpjb3ZlcjtvYmplY3QtZml0OmNvdmVyO3dpZHRoOjEwMCUgIWltcG9ydGFudDtkaXNwbGF5OmJsb2NrfS50Yi1nYWxsZXJ5X19jYXB0aW9ue3Bvc2l0aW9uOmFic29sdXRlO2JvdHRvbTowO3dpZHRoOjEwMCU7YmFja2dyb3VuZDpyZ2JhKDI1NSwyNTUsMjU1LDAuNik7cGFkZGluZzo1cHggMnB4O3RleHQtYWxpZ246Y2VudGVyO2NvbG9yOiMzMzN9LnRiLWdhbGxlcnlfX2NhcHRpb246ZW1wdHl7YmFja2dyb3VuZDp0cmFuc3BhcmVudCAhaW1wb3J0YW50fS50Yi1nYWxsZXJ5IC50Yi1icmlja19fY29udGVudCBmaWd1cmV7aGVpZ2h0OjEwMCV9LnRiLWdhbGxlcnkgaW1ne3dpZHRoOjEwMCU7aGVpZ2h0OjEwMCU7LW8tb2JqZWN0LWZpdDpjb3ZlcjtvYmplY3QtZml0OmNvdmVyO3ZlcnRpY2FsLWFsaWduOmJvdHRvbX0jbGVmdC1hcmVhIHVsLnRiLWdhbGxlcnl7bGlzdC1zdHlsZS10eXBlOm5vbmU7cGFkZGluZzowfSAudGItZ2FsbGVyeVtkYXRhLXRvb2xzZXQtYmxvY2tzLWdhbGxlcnk9IjNlZWVkM2JiODYyZDQ2YmI5ODgzNzI1NGZhZWZkYTc2Il0geyBtYXJnaW4tdG9wOiAzMHB4OyB9IC50Yi1nYWxsZXJ5W2RhdGEtdG9vbHNldC1ibG9ja3MtZ2FsbGVyeT0iM2VlZWQzYmI4NjJkNDZiYjk4ODM3MjU0ZmFlZmRhNzYiXSAudGItZ2FsbGVyeV9fY2FwdGlvbiB7IGJvdHRvbTogNXB4OyB9IC50Yi1nYWxsZXJ5W2RhdGEtdG9vbHNldC1ibG9ja3MtZ2FsbGVyeT0iM2VlZWQzYmI4NjJkNDZiYjk4ODM3MjU0ZmFlZmRhNzYiXSAudGItZ2FsbGVyeS0tbWFzb25yeSB7IGdyaWQtdGVtcGxhdGUtY29sdW1uczogbWlubWF4KDAsIDFmcikgbWlubWF4KDAsIDFmcikgbWlubWF4KDAsIDFmcik7Z3JpZC1jb2x1bW4tZ2FwOiA1cHg7IH0gLnRiLWdhbGxlcnlbZGF0YS10b29sc2V0LWJsb2Nrcy1nYWxsZXJ5PSIzZWVlZDNiYjg2MmQ0NmJiOTg4MzcyNTRmYWVmZGE3NiJdIC50Yi1nYWxsZXJ5LS1tYXNvbnJ5IC50Yi1icmlja19fY29udGVudCB7IHBhZGRpbmc6IDAgMCA1cHggMDsgfSBAbWVkaWEgb25seSBzY3JlZW4gYW5kIChtYXgtd2lkdGg6IDc4MXB4KSB7IC50Yi1nYWxsZXJ5IHVse2xpc3Qtc3R5bGU6bm9uZTttYXJnaW46MCAwIDEuNWVtIDA7cGFkZGluZzowfS50Yi1nYWxsZXJ5X19jZWxse21hcmdpbjowICFpbXBvcnRhbnQ7cG9zaXRpb246cmVsYXRpdmV9LnRiLWdhbGxlcnktLWdyaWR7ZGlzcGxheTpncmlkO2dyaWQtYXV0by1yb3dzOmF1dG8gIWltcG9ydGFudH0udGItZ2FsbGVyeS0tZ3JpZDpub3QoLnRiLWdhbGxlcnktLWdyaWQtLW5vY3JvcCkgLnRiLWJyaWNrX19jb250ZW50e2hlaWdodDoxMDAlO3Bvc2l0aW9uOmFic29sdXRlO3RvcDowfS50Yi1nYWxsZXJ5LS1ncmlkOm5vdCgudGItZ2FsbGVyeS0tZ3JpZC0tbm9jcm9wKSAudGItZ2FsbGVyeV9fY2VsbHtncmlkLXJvdy1lbmQ6dW5zZXQgIWltcG9ydGFudDtwb3NpdGlvbjpyZWxhdGl2ZX0udGItZ2FsbGVyeS0tZ3JpZDpub3QoLnRiLWdhbGxlcnktLWdyaWQtLW5vY3JvcCkgLnRiLWdhbGxlcnlfX2NlbGw6OmJlZm9yZXtjb250ZW50OiIiO2Rpc3BsYXk6aW5saW5lLWJsb2NrO3BhZGRpbmctYm90dG9tOjEwMCV9LnRiLWdhbGxlcnktLWdyaWQ6bm90KC50Yi1nYWxsZXJ5LS1ncmlkLS1ub2Nyb3ApIC50Yi1nYWxsZXJ5X19jZWxsOjptYXJrZXJ7Y29udGVudDoiIn0udGItZ2FsbGVyeS0tZ3JpZDpub3QoLnRiLWdhbGxlcnktLWdyaWQtLW5vY3JvcCkgaW1ne3dpZHRoOjEwMCU7aGVpZ2h0OjEwMCU7LW8tb2JqZWN0LWZpdDpjb3ZlcjtvYmplY3QtZml0OmNvdmVyfS50Yi1nYWxsZXJ5LS1ncmlkLS1ub2Nyb3AgaW1ne2hlaWdodDphdXRvICFpbXBvcnRhbnQ7d2lkdGg6YXV0byAhaW1wb3J0YW50fS50Yi1nYWxsZXJ5LS1ncmlkLS1ub2Nyb3AgLnRiLWdhbGxlcnlfX2NlbGx7YWxpZ24tc2VsZjplbmR9LnRiLWdhbGxlcnktLWdyaWQtLW5vY3JvcCAudGItYnJpY2tfX2NvbnRlbnR7aGVpZ2h0OjEwMCV9LnRiLWdhbGxlcnktLWNvbGxhZ2V7ZGlzcGxheTpncmlkO2dyaWQtdGVtcGxhdGUtY29sdW1uczpyZXBlYXQoMTIsIDFmcil9LnRiLWdhbGxlcnktLWNvbGxhZ2UgLnRiLWJyaWNrX19jb250ZW50e2hlaWdodDoxMDAlfS50Yi1nYWxsZXJ5LS1jb2xsYWdlIGltZ3toZWlnaHQ6MTAwJSAhaW1wb3J0YW50fS50Yi1nYWxsZXJ5LS1tYXNvbnJ5e2Rpc3BsYXk6Z3JpZDtncmlkLXJvdy1nYXA6MDtncmlkLWF1dG8tcm93czoxcHg7b3BhY2l0eTowfS50Yi1nYWxsZXJ5LS1tYXNvbnJ5IC50Yi1icmlja19fY29udGVudHtwb3NpdGlvbjpyZWxhdGl2ZX0udGItZ2FsbGVyeS0tbWFzb25yeSAudGItYnJpY2tfX2NvbnRlbnQgaW1nLC50Yi1nYWxsZXJ5LS1tYXNvbnJ5IC50Yi1icmlja19fY29udGVudCBpZnJhbWUsLnRiLWdhbGxlcnktLW1hc29ucnkgLnRiLWJyaWNrX19jb250ZW50IHZpZGVvey1vLW9iamVjdC1maXQ6Y292ZXI7b2JqZWN0LWZpdDpjb3Zlcjt3aWR0aDoxMDAlICFpbXBvcnRhbnQ7ZGlzcGxheTpibG9ja30udGItZ2FsbGVyeV9fY2FwdGlvbntwb3NpdGlvbjphYnNvbHV0ZTtib3R0b206MDt3aWR0aDoxMDAlO2JhY2tncm91bmQ6cmdiYSgyNTUsMjU1LDI1NSwwLjYpO3BhZGRpbmc6NXB4IDJweDt0ZXh0LWFsaWduOmNlbnRlcjtjb2xvcjojMzMzfS50Yi1nYWxsZXJ5X19jYXB0aW9uOmVtcHR5e2JhY2tncm91bmQ6dHJhbnNwYXJlbnQgIWltcG9ydGFudH0udGItZ2FsbGVyeSAudGItYnJpY2tfX2NvbnRlbnQgZmlndXJle2hlaWdodDoxMDAlfS50Yi1nYWxsZXJ5IGltZ3t3aWR0aDoxMDAlO2hlaWdodDoxMDAlOy1vLW9iamVjdC1maXQ6Y292ZXI7b2JqZWN0LWZpdDpjb3Zlcjt2ZXJ0aWNhbC1hbGlnbjpib3R0b219I2xlZnQtYXJlYSB1bC50Yi1nYWxsZXJ5e2xpc3Qtc3R5bGUtdHlwZTpub25lO3BhZGRpbmc6MH0gLnRiLWdhbGxlcnlbZGF0YS10b29sc2V0LWJsb2Nrcy1nYWxsZXJ5PSIzZWVlZDNiYjg2MmQ0NmJiOTg4MzcyNTRmYWVmZGE3NiJdIC50Yi1nYWxsZXJ5X19jYXB0aW9uIHsgYm90dG9tOiA1cHg7IH0gLnRiLWdhbGxlcnlbZGF0YS10b29sc2V0LWJsb2Nrcy1nYWxsZXJ5PSIzZWVlZDNiYjg2MmQ0NmJiOTg4MzcyNTRmYWVmZGE3NiJdIC50Yi1nYWxsZXJ5LS1tYXNvbnJ5IHsgZ3JpZC10ZW1wbGF0ZS1jb2x1bW5zOiBtaW5tYXgoMCwgMWZyKSBtaW5tYXgoMCwgMWZyKSBtaW5tYXgoMCwgMWZyKTtncmlkLWNvbHVtbi1nYXA6IDVweDsgfSAudGItZ2FsbGVyeVtkYXRhLXRvb2xzZXQtYmxvY2tzLWdhbGxlcnk9IjNlZWVkM2JiODYyZDQ2YmI5ODgzNzI1NGZhZWZkYTc2Il0gLnRiLWdhbGxlcnktLW1hc29ucnkgLnRiLWJyaWNrX19jb250ZW50IHsgcGFkZGluZzogMCAwIDVweCAwOyB9ICB9IEBtZWRpYSBvbmx5IHNjcmVlbiBhbmQgKG1heC13aWR0aDogNTk5cHgpIHsgLnRiLWdhbGxlcnkgdWx7bGlzdC1zdHlsZTpub25lO21hcmdpbjowIDAgMS41ZW0gMDtwYWRkaW5nOjB9LnRiLWdhbGxlcnlfX2NlbGx7bWFyZ2luOjAgIWltcG9ydGFudDtwb3NpdGlvbjpyZWxhdGl2ZX0udGItZ2FsbGVyeS0tZ3JpZHtkaXNwbGF5OmdyaWQ7Z3JpZC1hdXRvLXJvd3M6YXV0byAhaW1wb3J0YW50fS50Yi1nYWxsZXJ5LS1ncmlkOm5vdCgudGItZ2FsbGVyeS0tZ3JpZC0tbm9jcm9wKSAudGItYnJpY2tfX2NvbnRlbnR7aGVpZ2h0OjEwMCU7cG9zaXRpb246YWJzb2x1dGU7dG9wOjB9LnRiLWdhbGxlcnktLWdyaWQ6bm90KC50Yi1nYWxsZXJ5LS1ncmlkLS1ub2Nyb3ApIC50Yi1nYWxsZXJ5X19jZWxse2dyaWQtcm93LWVuZDp1bnNldCAhaW1wb3J0YW50O3Bvc2l0aW9uOnJlbGF0aXZlfS50Yi1nYWxsZXJ5LS1ncmlkOm5vdCgudGItZ2FsbGVyeS0tZ3JpZC0tbm9jcm9wKSAudGItZ2FsbGVyeV9fY2VsbDo6YmVmb3Jle2NvbnRlbnQ6IiI7ZGlzcGxheTppbmxpbmUtYmxvY2s7cGFkZGluZy1ib3R0b206MTAwJX0udGItZ2FsbGVyeS0tZ3JpZDpub3QoLnRiLWdhbGxlcnktLWdyaWQtLW5vY3JvcCkgLnRiLWdhbGxlcnlfX2NlbGw6Om1hcmtlcntjb250ZW50OiIifS50Yi1nYWxsZXJ5LS1ncmlkOm5vdCgudGItZ2FsbGVyeS0tZ3JpZC0tbm9jcm9wKSBpbWd7d2lkdGg6MTAwJTtoZWlnaHQ6MTAwJTstby1vYmplY3QtZml0OmNvdmVyO29iamVjdC1maXQ6Y292ZXJ9LnRiLWdhbGxlcnktLWdyaWQtLW5vY3JvcCBpbWd7aGVpZ2h0OmF1dG8gIWltcG9ydGFudDt3aWR0aDphdXRvICFpbXBvcnRhbnR9LnRiLWdhbGxlcnktLWdyaWQtLW5vY3JvcCAudGItZ2FsbGVyeV9fY2VsbHthbGlnbi1zZWxmOmVuZH0udGItZ2FsbGVyeS0tZ3JpZC0tbm9jcm9wIC50Yi1icmlja19fY29udGVudHtoZWlnaHQ6MTAwJX0udGItZ2FsbGVyeS0tY29sbGFnZXtkaXNwbGF5OmdyaWQ7Z3JpZC10ZW1wbGF0ZS1jb2x1bW5zOnJlcGVhdCgxMiwgMWZyKX0udGItZ2FsbGVyeS0tY29sbGFnZSAudGItYnJpY2tfX2NvbnRlbnR7aGVpZ2h0OjEwMCV9LnRiLWdhbGxlcnktLWNvbGxhZ2UgaW1ne2hlaWdodDoxMDAlICFpbXBvcnRhbnR9LnRiLWdhbGxlcnktLW1hc29ucnl7ZGlzcGxheTpncmlkO2dyaWQtcm93LWdhcDowO2dyaWQtYXV0by1yb3dzOjFweDtvcGFjaXR5OjB9LnRiLWdhbGxlcnktLW1hc29ucnkgLnRiLWJyaWNrX19jb250ZW50e3Bvc2l0aW9uOnJlbGF0aXZlfS50Yi1nYWxsZXJ5LS1tYXNvbnJ5IC50Yi1icmlja19fY29udGVudCBpbWcsLnRiLWdhbGxlcnktLW1hc29ucnkgLnRiLWJyaWNrX19jb250ZW50IGlmcmFtZSwudGItZ2FsbGVyeS0tbWFzb25yeSAudGItYnJpY2tfX2NvbnRlbnQgdmlkZW97LW8tb2JqZWN0LWZpdDpjb3ZlcjtvYmplY3QtZml0OmNvdmVyO3dpZHRoOjEwMCUgIWltcG9ydGFudDtkaXNwbGF5OmJsb2NrfS50Yi1nYWxsZXJ5X19jYXB0aW9ue3Bvc2l0aW9uOmFic29sdXRlO2JvdHRvbTowO3dpZHRoOjEwMCU7YmFja2dyb3VuZDpyZ2JhKDI1NSwyNTUsMjU1LDAuNik7cGFkZGluZzo1cHggMnB4O3RleHQtYWxpZ246Y2VudGVyO2NvbG9yOiMzMzN9LnRiLWdhbGxlcnlfX2NhcHRpb246ZW1wdHl7YmFja2dyb3VuZDp0cmFuc3BhcmVudCAhaW1wb3J0YW50fS50Yi1nYWxsZXJ5IC50Yi1icmlja19fY29udGVudCBmaWd1cmV7aGVpZ2h0OjEwMCV9LnRiLWdhbGxlcnkgaW1ne3dpZHRoOjEwMCU7aGVpZ2h0OjEwMCU7LW8tb2JqZWN0LWZpdDpjb3ZlcjtvYmplY3QtZml0OmNvdmVyO3ZlcnRpY2FsLWFsaWduOmJvdHRvbX0jbGVmdC1hcmVhIHVsLnRiLWdhbGxlcnl7bGlzdC1zdHlsZS10eXBlOm5vbmU7cGFkZGluZzowfSAudGItZ2FsbGVyeVtkYXRhLXRvb2xzZXQtYmxvY2tzLWdhbGxlcnk9IjNlZWVkM2JiODYyZDQ2YmI5ODgzNzI1NGZhZWZkYTc2Il0gLnRiLWdhbGxlcnlfX2NhcHRpb24geyBib3R0b206IDVweDsgfSAudGItZ2FsbGVyeVtkYXRhLXRvb2xzZXQtYmxvY2tzLWdhbGxlcnk9IjNlZWVkM2JiODYyZDQ2YmI5ODgzNzI1NGZhZWZkYTc2Il0gLnRiLWdhbGxlcnktLW1hc29ucnkgeyBncmlkLXRlbXBsYXRlLWNvbHVtbnM6IG1pbm1heCgwLCAxZnIpIG1pbm1heCgwLCAxZnIpIG1pbm1heCgwLCAxZnIpO2dyaWQtY29sdW1uLWdhcDogNXB4OyB9IC50Yi1nYWxsZXJ5W2RhdGEtdG9vbHNldC1ibG9ja3MtZ2FsbGVyeT0iM2VlZWQzYmI4NjJkNDZiYjk4ODM3MjU0ZmFlZmRhNzYiXSAudGItZ2FsbGVyeS0tbWFzb25yeSAudGItYnJpY2tfX2NvbnRlbnQgeyBwYWRkaW5nOiAwIDAgNXB4IDA7IH0gIH0g

Leave a Reply

You must be logged in to post a comment.